- Integrity Report

- Posts

- Integrity Report

Integrity Report

Your Trusted Source for Fraud Prevention Insights

Hot Topics:

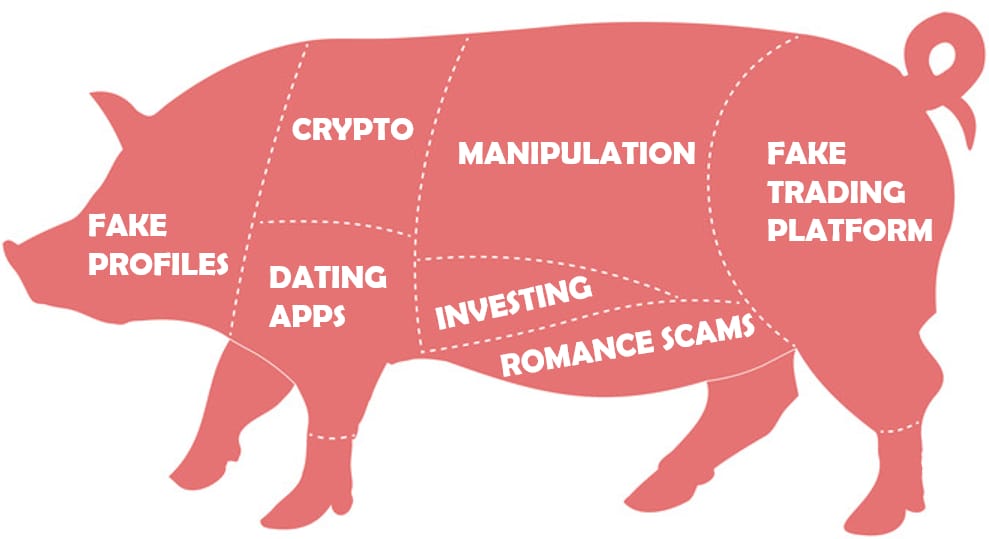

Slaughtered by Trust: The Rise of the Pig Butchering Scam

The pig butchering scheme is a sophisticated type of online investment scam that originated in China and has spread globally. The name refers to the process of "fattening up" the victim—much like a pig—before "butchering" them for a large financial payoff. Scammers build trust with their targets over days, weeks, or even months through fake romantic or friendship relationships, often initiated on dating apps or social media platforms. Once a strong emotional connection is established, the scammer gradually introduces the victim to what appears to be a legitimate investment opportunity, typically involving cryptocurrency or foreign exchange markets.

What makes pig butchering schemes particularly dangerous is the elaborate setup. Scammers use polished websites, fake trading apps, and even real-time "customer service" representatives to create an illusion of legitimacy. Victims are encouraged to make small, successful trades initially, which show profits, further convincing them to invest more. Eventually, when the victim tries to withdraw funds, they're blocked or asked to pay taxes or fees—only to realize too late that their money is gone. These scams have resulted in billions of dollars in losses worldwide and are often run by organized criminal groups, sometimes using trafficked labor to operate their scam centers.

Sweet Talk, Sour Signs: Spot the Red Flags Early

Unexpected Contact from a Stranger

– The scam often starts with a message from someone you don’t know, typically on dating apps, social media, or even random text messages ("Hi, is this Alex?").Quick Development of a Close Relationship

– The scammer will try to build emotional trust fast—showering you with attention, compliments, and talk of a future together.Talk of Wealth and Investments

– The person may casually mention they make good money through crypto or forex trading and offer to “teach” or help you invest.Too-Good-to-Be-True Investment Returns

– You're shown fake profits from small initial investments to lure you into putting in larger sums.Use of Off-Platform Apps or Websites

– They may direct you to unofficial trading platforms or apps that mimic real ones, making it seem like your money is growing.Pressure to Act Quickly

– Scammers often push for urgency, saying things like “this opportunity won’t last” or “now is the perfect time to buy in.”Requests for Crypto Transfers

– They’ll usually ask you to transfer money via cryptocurrency wallets, which are nearly impossible to trace or recover.Refusal to Video Chat or Meet in Person

– They avoid face-to-face communication and offer excuses when asked to meet or verify their identity.Trouble Withdrawing Funds

– When you try to take your money out, you're blocked or told you need to pay fees, taxes, or additional deposits.Too Polished and Persistent

– Scammers are often unusually patient, polite, and consistent, using scripts and fake personas perfected by criminal networks.

If you notice any of these signs, it’s best to stop all communication, report the profile, and never send money or share sensitive personal information.

In the News:

Unmasking the Crypto Con: DOJ Traces $225M to Pig Butchering Scheme

The U.S. Department of Justice (DOJ) announced it has filed a civil complaint to seize approximately $225.3 million in cryptocurrency tied to widespread crypto investment scams. According to the DOJ, the funds came from over 400 victims who were targeted through a sophisticated blockchain-based money laundering network, largely operating under the “pig butchering” model. This type of scam involves scammers building long-term trust—often through fake romantic relationships—before convincing victims to invest in fraudulent crypto platforms. The DOJ revealed that Tether and crypto exchange OKX were instrumental in flagging suspicious accounts, helping law enforcement trace the stolen funds.

The 75-page complaint details how the FBI and U.S. Secret Service tracked the funds across seven groups of Tether stablecoins, allegedly used by scammers to obscure and move illicit gains. Notably, one victim, Shan Hanes, a former bank president, embezzled millions to invest in one of these scams and is now serving a 24-year prison sentence. Other victims, who were not involved in criminal activity themselves, reportedly lost significant amounts. An FBI report cited in the case says crypto investment fraud totaled $5.8 billion in losses in 2024 alone.

The DOJ states that recovered funds will go toward compensating victims, though if some funds go unclaimed, they may be redirected toward creating a U.S. cryptocurrency reserve. (Read More)

Fraud Flixs:

The Tinder Swindler on Netflix

The Tinder Swindler is a 2022 Netflix documentary directed by Felicity Morris, detailing the true story of Israeli con artist Shimon Hayut, who posed as Simon Leviev, the son of a wealthy diamond magnate. Using the dating app Tinder, Hayut charmed women by presenting a lavish lifestyle, including private jet trips and luxury accommodations. Once trust was established, he fabricated stories of danger from "enemies" and convinced his victims to lend him substantial sums of money, which he never repaid. The documentary follows the experiences of several women who were deceived and their subsequent efforts to expose him.

Hayut's fraudulent activities spanned multiple countries and involved a complex web of deceit. Despite his criminal history, including previous convictions in Finland and Israel, he continued his scams across Europe. The film highlights the emotional and financial toll on the victims, as well as the challenges they faced in seeking justice. Following the documentary's release, Hayut was banned from several dating platforms, and his story sparked widespread discussions about online dating safety and the prevalence of romance scams. (See Video)

Fraud Quiz:

Test your Knowledge

Which of the following is a common tactic used in pig butchering scams?

A. Asking for donations to a fake charity

B. Claiming you’ve won a prize and need to pay a fee

C. Building a fake relationship to gain trust, then pushing fake crypto investments

D. Threatening legal action unless you pay immediately

Scroll down to find out if you got the answer right!

Fraud Facts:

The FBI and FTC reported that in 2024…

Crypto investment fraud losses topped $5.8 billion

The Final Word:

Fraud Quiz Answers

The answer is #C - Scammers in pig butchering schemes often lure victims to fake or unregulated investment platforms that look professional but are designed to steal money. Always verify platforms through official channels and never invest based solely on someone's recommendation—especially if you’ve only met online.

At MPR Group LLC, our Investigation and Anti-Fraud experts are here to help you spot the red flags before they become costly problems. From proactive risk assessments to discreet internal investigations, we empower your business to stay one step ahead of fraud—because prevention is always better than damage control.

Let us protect what you’ve worked so hard to build.

Reply