- Integrity Report

- Posts

- Integrity Report

Integrity Report

Your Trusted Source for Fraud Prevention Insights

Hot Topics:

Scams in the North Star State: Inside Minnesota’s Fraud Problem

Feeding Our Future was a Minnesota-based nonprofit that, during the COVID-19 pandemic, was supposed to help child care programs participate in the Federal Child Nutrition Program. Instead, federal prosecutors say its leadership and a network of associated sites engaged in one of the largest pandemic-era fraud schemes in U.S. history. Between 2020 and 2022, the organization dramatically expanded, enrolling more than 250 federally funded sites and submitting fraudulent claims for millions of meals that were never actually served to children. Officials allege that Feeding Our Future and its co-conspirators fabricated attendance rosters, meal counts, and invoices to obtain reimbursements — ultimately siphoning off hundreds of millions of dollars in federal nutrition funding.

Federal authorities have aggressively pursued the case, charging at least 78 individuals, with approximately 55 pleading guilty and seven convicted at trial on fraud, money-laundering, and related charges. This includes the nonprofit’s leader, Aimee Bock, and co-defendant Salim Said, who were convicted by a federal jury on multiple counts related to wire fraud, bribery, and conspiracy.

Prosecutors have documented how the stolen funds were used for luxury vehicles, real estate, overseas travel and other personal enrichment, rather than feeding children in need. The scope of the scandal has also sparked broader scrutiny of state oversight of federal aid programs in Minnesota and triggered political controversy and expanded federal investigations into similar fraud across multiple public benefit programs

Red Flags Officials Failed to Act On

Unrealistic growth and meal counts

– Feeding Our Future went from a small nonprofit to overseeing hundreds of meal sites in a very short time. Some sites claimed to serve thousands of meals per day, far more than the number of children in the area or the physical capacity of the locations.Weak documentation and repeated paperwork issues

– Many sites submitted nearly identical meal counts day after day, which is highly unusual in real meal programs. Invoices, attendance rosters, and food vendor records were often incomplete, inconsistent, or clearly inflated.Conflicts of interest

– Individuals connected to the nonprofit and its meal sites were linked through family or business relationships, a classic fraud warning sign.Unexplained luxury spending

– Large amounts of federal money were being spent on luxury cars, expensive homes, designer goods, and international travel—spending that didn’t match the nonprofit’s mission of feeding low-income children.Limited oversight during the pandemic

– COVID-19 emergency waivers reduced in-person inspections and relaxed some rules to get food to children faster. Fraudsters exploited this gap, knowing that site visits and verification were rare. Even when whistleblowers and state officials raised alarms, the system lacked fast, coordinated enforcement to stop the scheme early.

Had these red flags been identified and acted on sooner, authorities could have halted the scheme before it spiraled, preventing millions of dollars in taxpayer funds from being misused and preserving resources intended to feed children in need.

In the News:

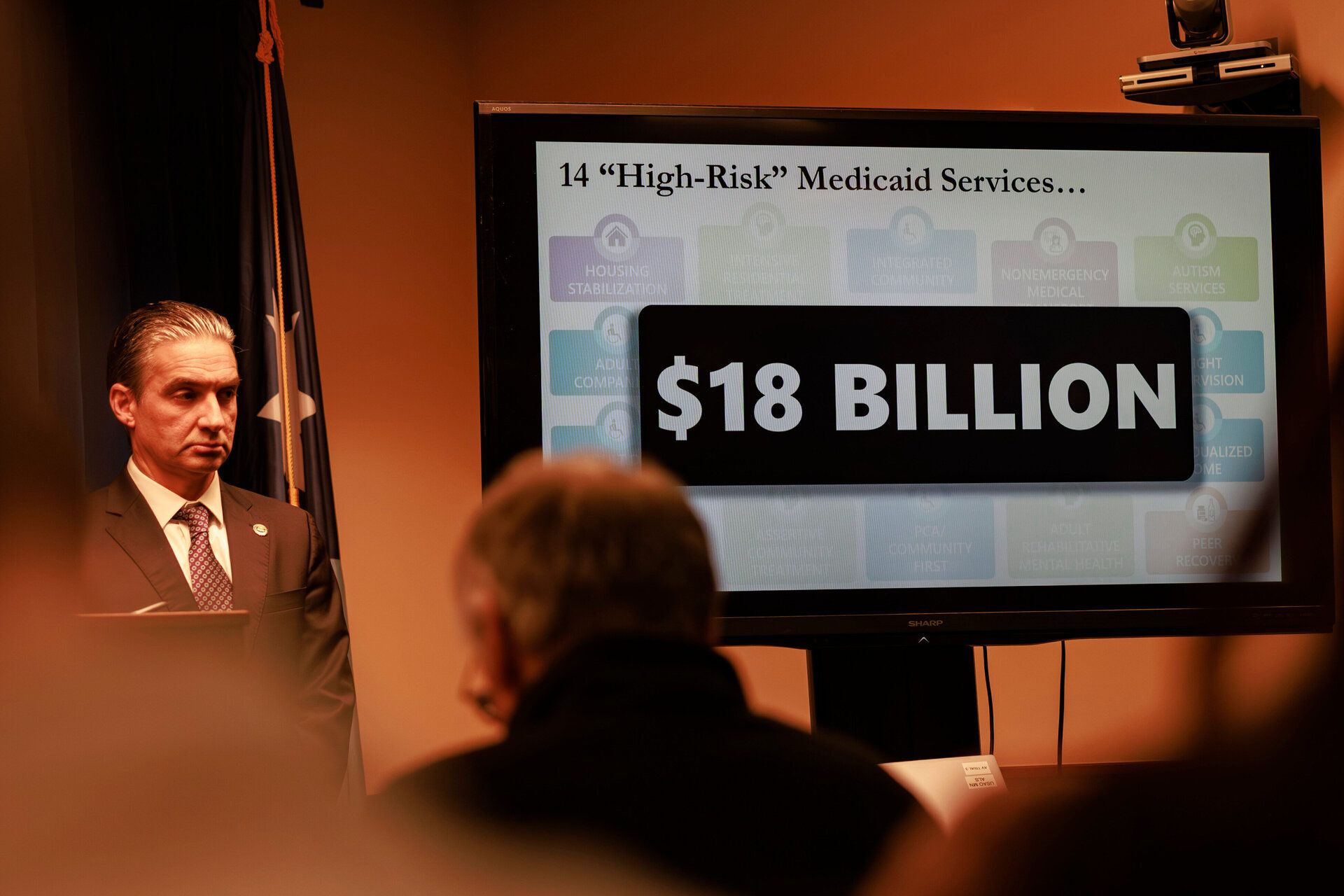

Prosecutor says 14 Minnesota programs are targeted for fraud and the state is swamped with crime

On December 18, 2025, First Assistant U.S. Attorney Joe Thompson announced a broad, multi‑layered federal fraud investigation into 14 Minnesota‑run social service programs funded largely through Medicaid. Thompson said that half or more of the roughly $18 billion in federal funds paid out to these programs since 2018 may have been falsely claimed or stolen, calling the situation “industrial‑scale fraud” and warning that it jeopardizes services for vulnerable populations such as adults exiting addiction treatment and children receiving autism therapy.

The investigation has identified various schemes where entities billed Medicaid for services that were never provided or fabricated entirely. Examples include defendants who created companies that did not deliver services yet submitted large reimbursement claims, with proceeds used for international travel, luxury vehicles and lavish lifestyles rather than legitimate care. The probe has spawned new charges, including five defendants linked to Minnesota’s Housing Stability Services Program, where individuals allegedly stole funds intended to help recipients find stable housing and submitted millions of dollars in fraudulent claims.

Officials also reported that the autism services program was exploited through fraudulent clinics that recruited children and billed millions in false Medicaid reimbursements, with at least one provider alleged to have submitted claims totaling millions of dollars. This broader focus on multiple programs grew out of earlier cases such as Feeding Our Future, the massive child nutrition fraud scheme that previously yielded dozens of convictions. State authorities, including Minnesota’s governor, have paused payments and launched audits of high‑risk programs in response, and critics have debated the adequacy of oversight that allowed these abuses to proliferate (Read More)

Fraud Flixs:

Inside the Mind of a Con Artist: The Science of Mega Scams

Inside the Mind of a Con Artist a documentary available on YouTube explores the psychological, behavioral, and neurological drivers of fraud and deception by getting inside the heads of real-world con artists. Using expert analysis from forensic psychologists, behavioral scientists, and neuroscientists, it breaks down what makes some criminals so skilled at manipulation — and why ordinary people fall for their schemes.

The documentary combines case studies, interviews, and expert insight to expose not just what these con artists did… but how and why they did it. It also reflects on human susceptibility to deception and the uncomfortable truths about belief, trust, and manipulation that we all share. (See Video)

Fraud Quiz:

Test your Knowledge

Which of the following is considered the largest fraud scam in U.S. history in terms of financial loss?

A. Enron accounting scandal

B. Bernie Madoff Ponzi scheme

C. WorldCom accounting fraud

D. Wells Fargo fake accounts scandal

Scroll down to find out if you got the answer right!

Fraud Facts:

Minnesota Prosecutors Have Prosecuted Over $500 Million in Fraud — and Losses Are Expected to Rise Exponentially

The Final Word:

Fraud Quiz Answers

The answer is #B - Madoff’s scheme defrauded investors of over $65 billion, making it the biggest financial fraud in U.S. history.

At MPR Group LLC, our Investigation and Anti-Fraud experts are here to help you spot the red flags before they become costly problems. From proactive risk assessments to discreet internal investigations, we empower your business to stay one step ahead of fraud—because prevention is always better than damage control.

Let us protect what you’ve worked so hard to build.

Reply